PH HQP-SLF-001 2012 free printable template

Show details

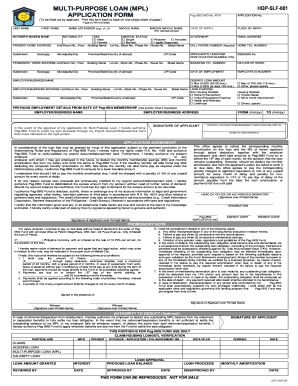

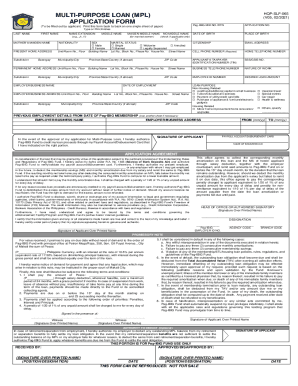

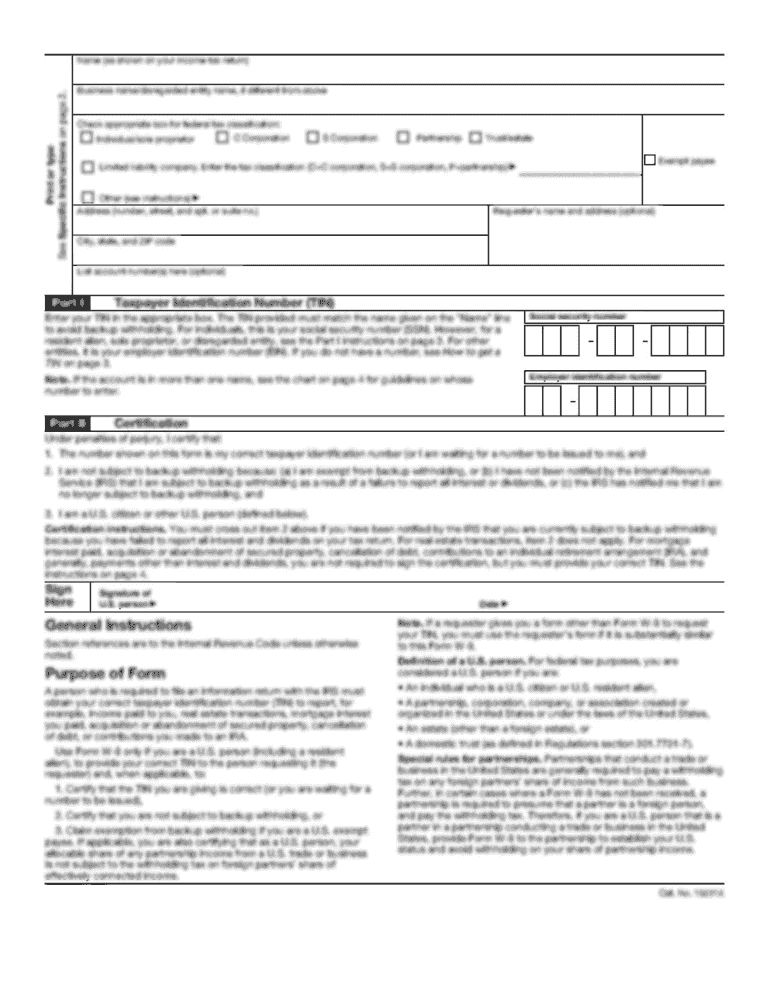

B. How to File The applicant shall 1. Secure the Multi-Purpose Loan Application Form MPLAF from any Pag-IBIG Fund NCR/Provincial branch. HQP-SLF-001 MULTI-PURPOSE LOAN APPLICATION FORM MPLAF APPLICATION No. TO BE FILLED OUT BY APPLICANT Type or print entries MIDDLE NAME MAIDEN NAME For married women DESIRED LOAN AMOUNT MAX OF 60 24-59 MOS. MAX OF 80 AT LEAST 120 MOS. MAX OF 70 60-119 MOS. OTHER AMOUNT PLS. SPECIFY HOME ADDRESS Pls. indicate complete address GENDER CIVIL STATUS EMPLOYEE No*...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan form multi 2012

Edit your loan form multi 2012 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan form multi 2012 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan form multi 2012 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit loan form multi 2012. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH HQP-SLF-001 Form Versions

Version

Form Popularity

Fillable & printabley

Fill

form

: Try Risk Free

People Also Ask about

How much is Pag Ibig salary loan?

A member can borrow up to 80% of their Pag-IBIG Regular Savings, and can be processed in as fast as 2 days! Read more below and learn how to secure cash through the Pag-IBIG Multi-Purpose Loan.

Can I process my pag ibig loan online?

You can easily apply for a Pag-IBIG MPL via the following options: Online, via Virtual Pag-IBIG by: Uploading your duly accomplished loan application form and requirements*; or. Completing the Pag-IBIG MPL application online form, for members whose employers are enrolled under the Virtual Pag-IBIG for Employers**

What are the steps to loan in Pag-IBIG?

Before getting started, please make sure to prepare the following: LOAN APPLICATION FORM. Photo or scanned copy of your LOAN APPLICATION FORM, containing the required information, your signature, the signature of your employer (if employed) and signature of two (2) witnesses. ONE (1) VALID ID. CASH CARD. SELFIE PHOTO.

How do you fill out a loan?

Home loan application form Check and gather everything from the list of documents required for the home loan. Log on to the official lender website and apply for a home loan by filling up the form with the following details. Personal information, i.e. name, address, date of birth. PIN code. Employment details. Monthly income.

How can I get my pag ibig loan?

Before getting started, please make sure to prepare the following: LOAN APPLICATION FORM. Photo or scanned copy of your LOAN APPLICATION FORM, containing the required information, your signature, the signature of your employer (if employed) and signature of two (2) witnesses. ONE (1) VALID ID. CASH CARD. SELFIE PHOTO.

How to fill loan application form?

Home loan application form Check and gather everything from the list of documents required for the home loan. Log on to the official lender website and apply for a home loan by filling up the form with the following details. Personal information, i.e. name, address, date of birth. PIN code. Employment details. Monthly income.

What are the 4 steps in the loan application process?

Personal Loan Process Step1: Check the Eligibility Criteria. Step 2: Check Interest Rates and Other Charges. Step 3: Calculate your EMI. Step 4: Check Required Documents. Step 5: Fill Application Form Online. Step 6: Wait for Loan Approval.

What do I put on a loan application?

Loan application This initial application is usually basic — it will often ask for your personal information, such as your name, address, phone number, date of birth, and Social Security number. It might also require you to state your desired loan amount and loan purpose.

How to fill credit application form?

0:31 1:56 Learn How to Fill the Credit Application form - YouTube YouTube Start of suggested clip End of suggested clip You must supply your banking information using the bank that you are using for your credit accountMoreYou must supply your banking information using the bank that you are using for your credit account submit their name address and contact information supplied.

How long is the process of Pag-IBIG loan online?

The Pag-IBIG Fund Multi-Purpose Loan or MPL is a cash loan designed to help our members with any immediate financial need. A member can borrow up to 80% of their Pag-IBIG Regular Savings, and can be processed in as fast as 2 days!

How can I check my Pag-IBIG loan online?

Virtual Pag-IBIG. For questions or to follow-up on your loan application, please call (02)8724-4244 or chat us by clicking on the icon found at the bottom right of your screen.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is loan form multi?

Loan form multi is a document that is used to apply for multiple loans simultaneously.

Who is required to file loan form multi?

Anyone who wants to apply for multiple loans at the same time is required to file loan form multi.

How to fill out loan form multi?

To fill out loan form multi, you need to provide all the required information about each loan you are applying for in the respective sections of the form.

What is the purpose of loan form multi?

The purpose of loan form multi is to streamline the application process for individuals who are seeking multiple loans at once.

What information must be reported on loan form multi?

Loan form multi requires you to report details such as loan amount, loan purpose, borrower information, financial statements, and any other information required by the lender.

How do I edit loan form multi 2012 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share loan form multi 2012 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete loan form multi 2012 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your loan form multi 2012. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I complete loan form multi 2012 on an Android device?

Use the pdfFiller app for Android to finish your loan form multi 2012. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your loan form multi 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Form Multi 2012 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.